LumenFocus’ tax experts can help you maximize your return on investment. We utilize a tax-centric asset strategy to off-set the use of cash. If you choose to upgrade your lighting to a newer, more efficient LumenFocus system, you could qualify for several tax deductions.

It is not uncommon to realize tax liability reductions of around 60 percent or more of your initial lighting upgrade investment. Utilizing our tax-centric design strategies – along with energy savings, maintenance savings, and qualified utility rebates – it is reasonable to expect an 80 percent or more off-set of cash in the first year.

Our approach can impact your positive cash flow in five ways:

1. Daily operating costs are lower

2. Usually no need for cash up-front

3. Utility rebates mean cash in the front door

4. Increase your building asset value

5. Reduce your current year tax liability

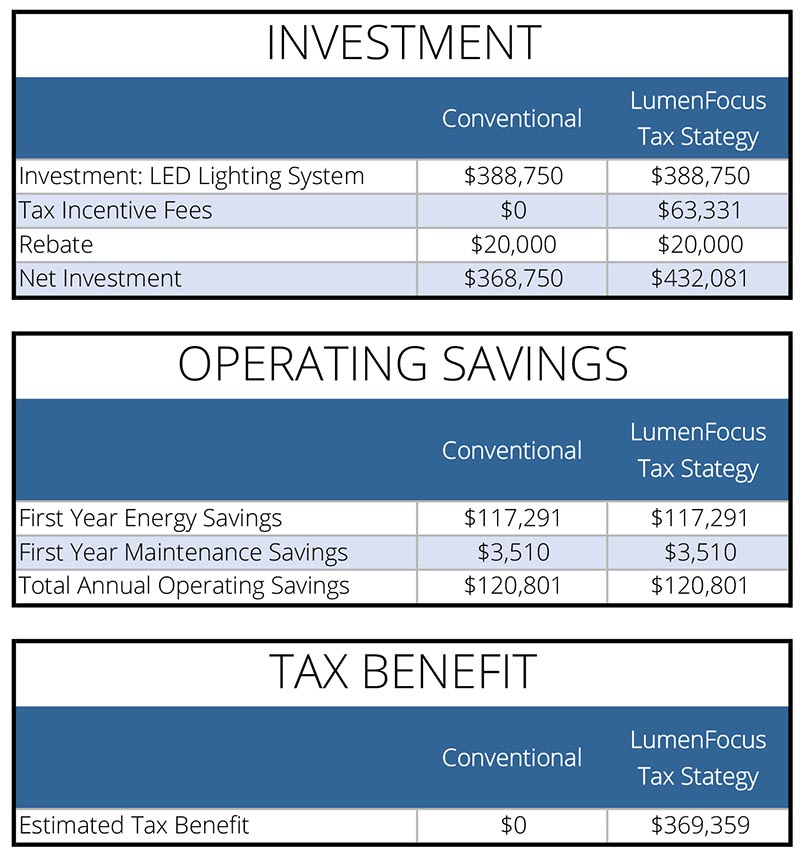

The below example compares our tax strategy to a conventional approach. The cost of the tax incentive fees was just over $63,000 in this scenario, but the estimated tax benefit is nearly $370,000.

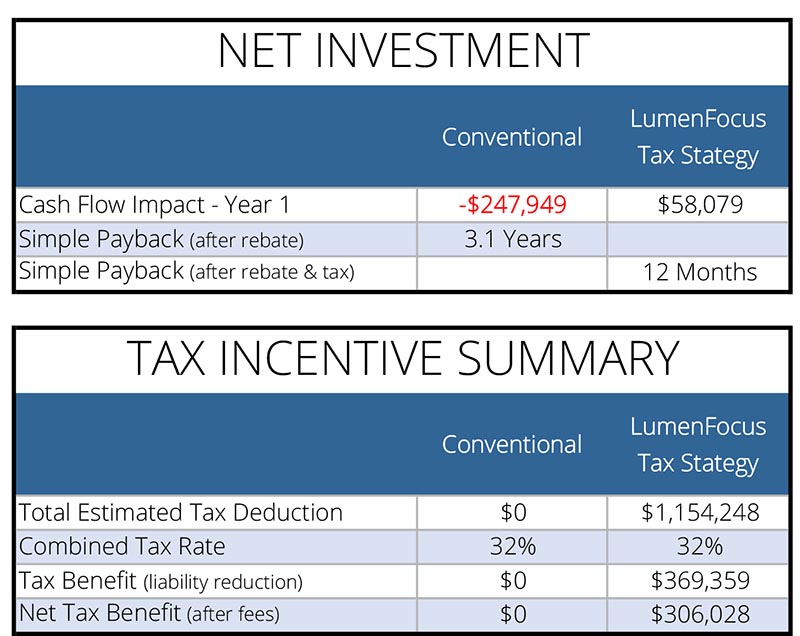

You can see the impact of Year 1 cash flow, and the dramatically reduced payback of using our tax strategies:

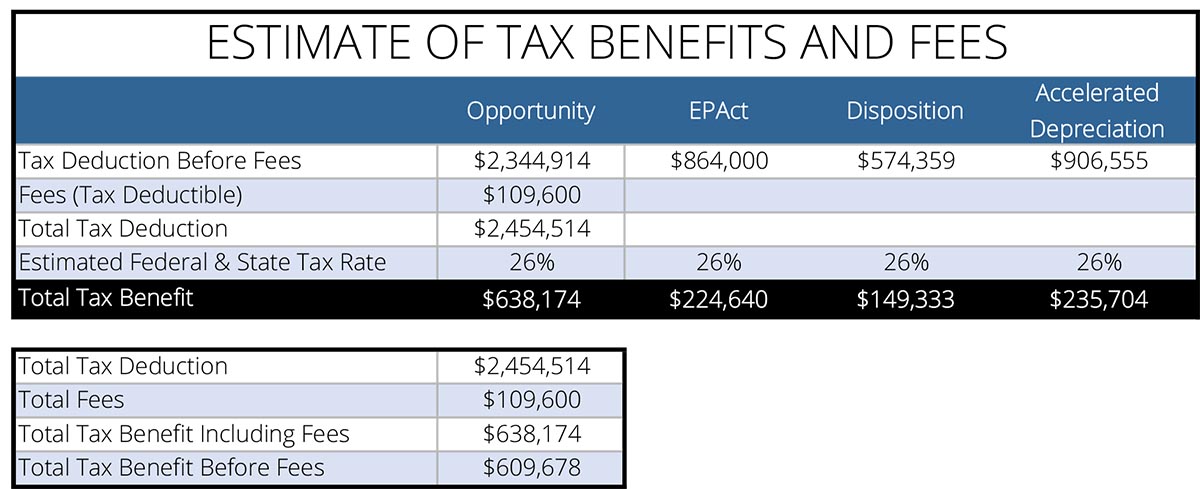

Below is another scenario, showing a breakout with EPAct, Disposition and Accelerated Disposition on a $2.3M opportunity.

EPAct (179D) applies to any capital investment in lighting, HVAC and/or your building envelope. It is set to expire on Dec. 31, 2020, but the tax benefits can be carried forward 20 years. If a qualified 179D tax deduction ocurred between Jan. 1, 2006 and Dec. 31, 2020, and was missed, it can be captured in the current year without amending taxes.

EPAct provides a tax deduction of up to $1.80 per square foot broken into three segments – $0.60 each of the building envelope, HVAC and lighting. In many cases, LED lighting can qualify for all three deductions. Contact us to find out how or if you qualify for more than the maximum allowable deduction for lighting.

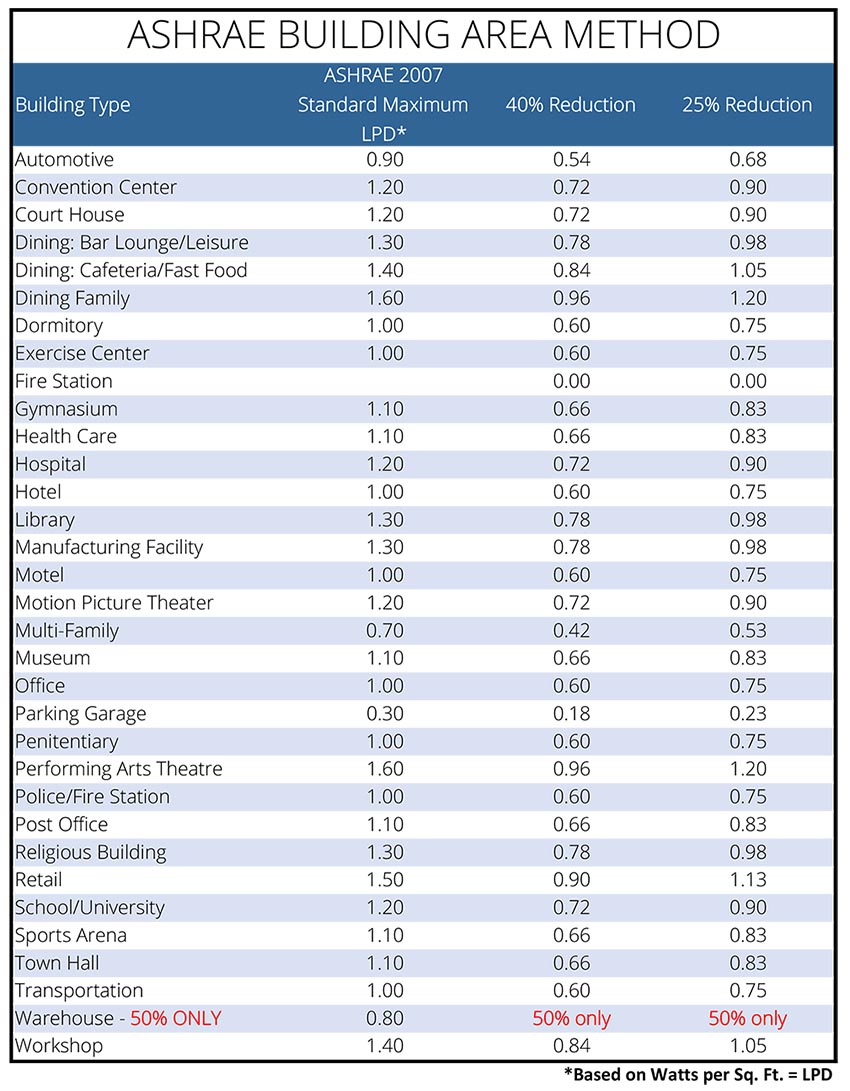

The below chart shows the percentage reduction compared to the maximum LPD (based on lighting power density, or watts per square feet) utilizing the ASHRAE Building Area Method:

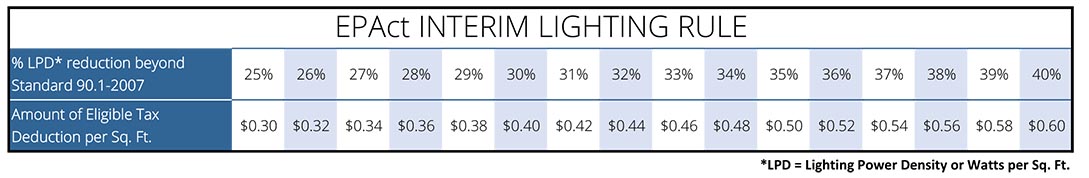

The below graphic shows the amount of eligible deduction using EPAct’s Interim Lighting Rules. At LumenFocus, we use the Interim Rule only when we cannot use the Building Area Method to capitalize on HVAC and envelope deductions, which can go back to January 1, 2006. The amount of the deduction is the lesser of the eligible tax deduction, or the costs incurred or paid for energy efficient property. Besides demonstrating a reduction in LPD, all controls provisions in the standard must be met, bi-level switching, and the minimum requirements for calculated light levels as set forth by the Illuminating Engineering Society. Important to note that warehouses spaces must be at least 50 percent below ASHRAE standards.

Accelerated depreciation is an IRS-accepted and common real estate strategy to accelerate depreciation on building assets. This method of generating current-year cash is typically not considered when investing in a lighting upgrade. There are several ways to incorporate these tax incentives and we can provide this service as well.

Note: These are sample scenarios, and are just estimates. The actual tax benefit and fees for your situation may differ, and they are subject to review of the end-user’s current tax depreciation schedule, and depends on the facts and circumstances regarding the depreciation treatment of real property.

Click here for an estimate of tax benefits request form. Note: Results contained in this report are estimates. Actual benefits can be provided upon completion of an asset audit of your facility and review of your asset tax records by our professional engineers and forensic CPAs. Also, entering your luminaires under the “Existing Lighting” or “New Lighting” tab is not required, but will allow for a more accurate assessment.

For more information on our tax services, or for any questions, email Frank Austin here.

For more information on our tax services, or for any questions, email Frank Austin here.

Let us put our tax-centric strategy to work for you today!